Skip Ahead

The primary Knowledge Graph use cases we see center around market intelligence, ecommerce, news monitoring, and machine learning. With that said, similar datasets and analysis techniques can yield a different set of organizations and individuals: investors.

The bedrock of investigating investments and potential investors within the Knowledge Graph is the investments field attached to organization entities. This field has a few components, all of which can yield useful data for both market intelligence, investing, or funding searches. In particular, the following sub-fields can be useful:

- Investment amount

- Investment currency

- Investment date

- Names and DiffbotUri’s for investing orgs

- “Importance” of investing orgs

- What series of funding rounds were raised

There are three basic motions that can yield insights for fundraising.

- Look at the specifics of investments in orgs similar to your own (e.g. ‘who invests in battery tech companies who are expanding in Asia?’)

- If orgs similar to your own don’t have many investments, look for orgs your org could be similar to in the future. Who invested in these orgs?

- Once you have a set of investing organizations, can you discern actionable intel? Who might you reach out to? What do these organizations write about? What are their focus areas? How would you pitch them?

Investors today operate globally, and to answer the above questions on this scale you’ll need a tool that can aggregate relationships between global organizations as well as monitor news from around the world (and potentially in many languages). Our Knowledge Graph is a cinch in both of these instances.

Who Invests In Companies Like Mine?

To show how the Knowledge Graph might be used in fundraising scenarios, let’s start with a hypothetical scenario. You’re a alternative energy company based on Arizona, and you want to expand throughout the region.

First off, let’s get a list of regional alternative energy companies. If you aren’t concerned with the specific state or nation, you can utilize the near parameter to look within a specific radius.

type:Organization industries:"Renewable Energy Companies" near[500mi](name:'Phoenix')

This query returns over 2,400 renewable energy companies within 500 miles of Phoenix, Arizona. This is likely too many companies to manually look through. So you’ll likely want to perform some facet searches to get a summary view of what is in this dataset.

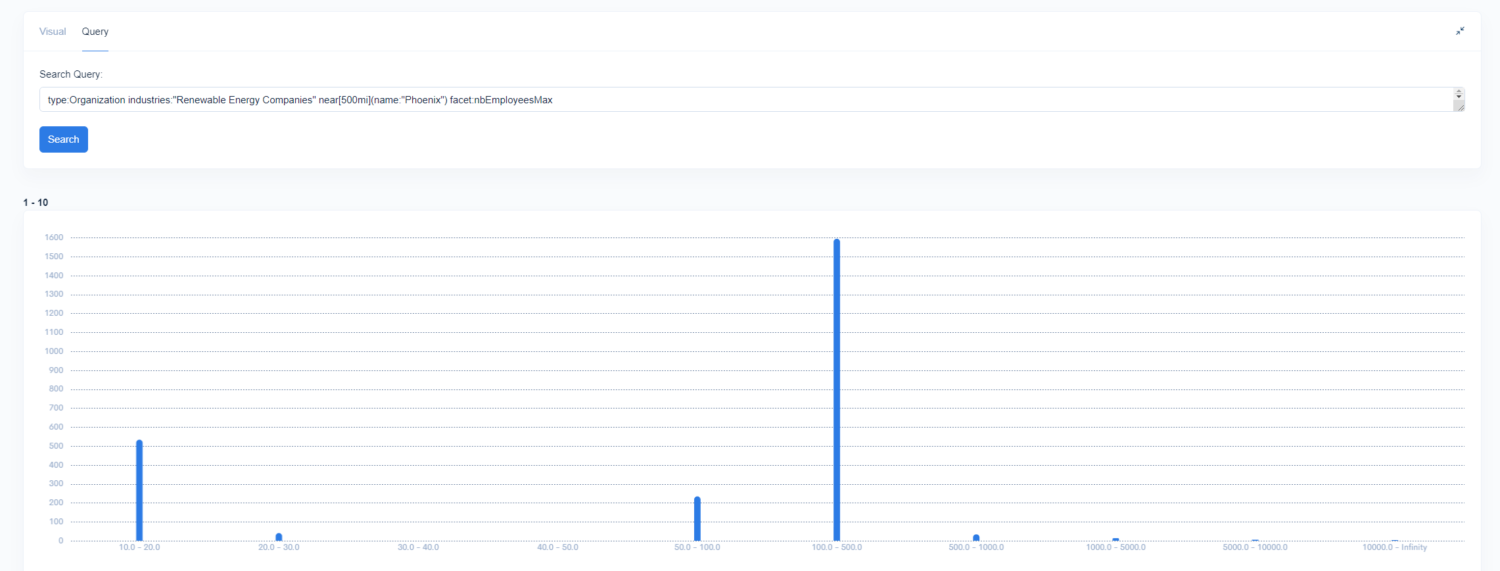

Adding facet:nbEmployeesMax provides a summary view of the number of employees of these organizations. It looks like this specific set of organizations primarily fall into three sizes: 100-500 FTEs, 10-20 FTEs, or 50-100 FTEs. While these clusters could be explained by the type of renewable energy product each company makes (e.g. software vs. large physical installations), these clusters also align with common headcounts associated with particular funding rounds. 10-20 FTEs, may be a bootstrap, seed, or angel round company. 50-100 FTEs may have raised a series A funding round, with 100-500 FTEs may be multiple funding rounds in.

In this hypothetical you have 20 employees, and need funding to expand your operations and grow into the slightly larger renewable energy companies. So let’s mine into the 50-100 FTE cluster.

The above query yields 236 organizations. A decent sample size from which to investigate past funding trends.

From here we can look at a summary of the organizations that invested in these organizations by adding facet:investments.investors.name to the end of the query. For this group of companies, only three investors have invested in multiple renewable energy companies in our list. 9 total investing organizations are present. If you need a larger list for outreach, you could try altering or removing the nbEmployeesMax fields. (Removing nbEmployeesMax returns >25 results, with 9 organizations who have invested in multiple of this set of renewable energy companies.)

This list of 9 investors could be your jumping off point for the third stage of this inquiry below. Or you could continue investigating to explore other angles for generating a list of potential investors.

What Similar Orgs Receive Investments?

Jumping to the second angle of inquiry we outlined in the intro, we can begin to look at the characteristics of organizations who gain investment in this industry. But first, let’s gain some insight into what types of investments have been attained by our similar organizations.

The above query returns sizable groupings for “series unknown,” “post IPO equity,” “seed,” “debt financing,” and “grant.” In our hypothetical our organization isn’t close to an IPO and is perhaps beyond seed funding stage. So let’s exclude organizations at these stages. One way to do this is to check what funding stage an organization is currently in. As organizations in series B have already gone through series A. This means organizations in the Knowledge Graph in series B would show up for searches looking for both series A and series B funding round recipient organizations. By using the isCurrent we can look at organizations currently in a given stage of funding.

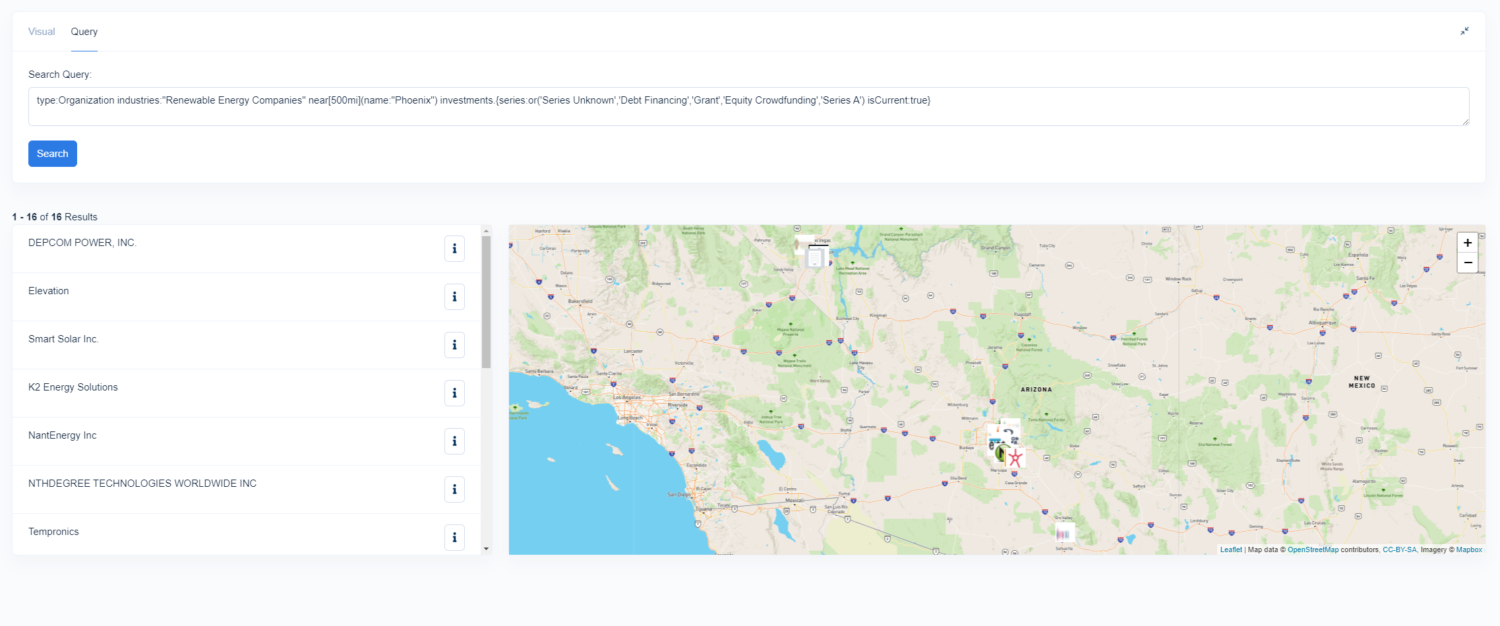

The above query returns 16 companies, a nice middle ground for some aggregation of values with the potential to deep dive into each.

By looking at results on our map view, we can see two clusters of activity. As in many industries, investment is higher in specific locales. In this case, Henderson/Las Vegas, Nevada and Phoenix, Arizona.

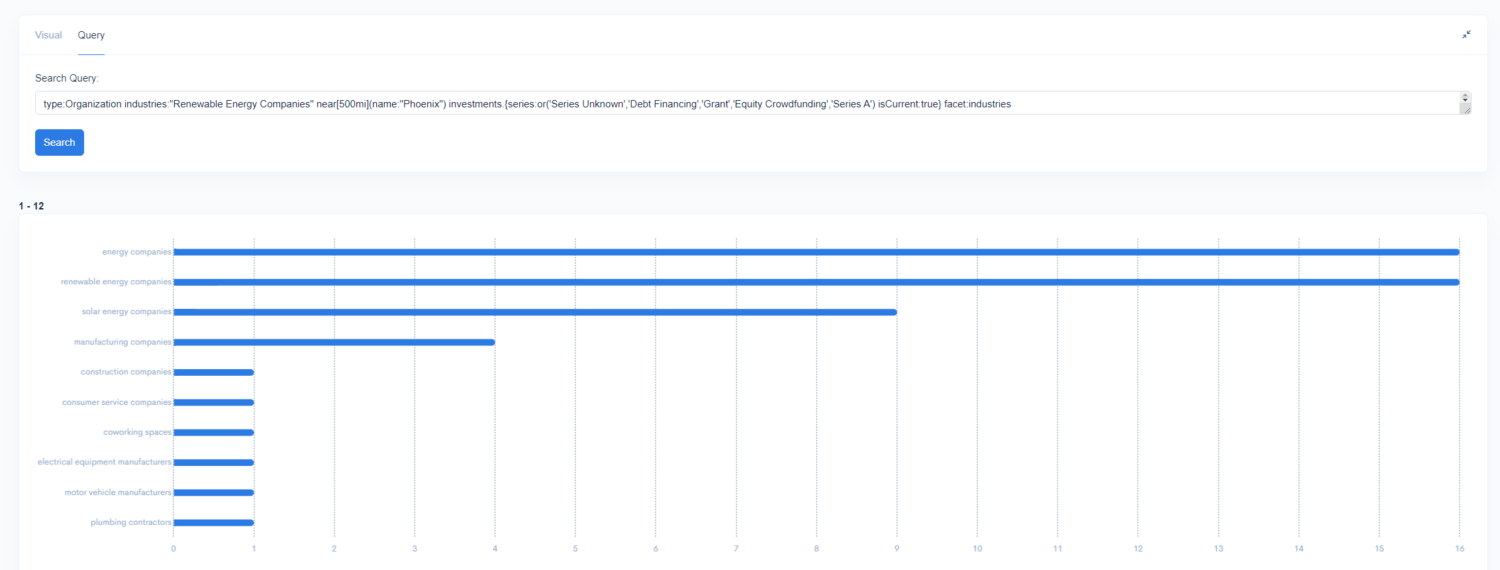

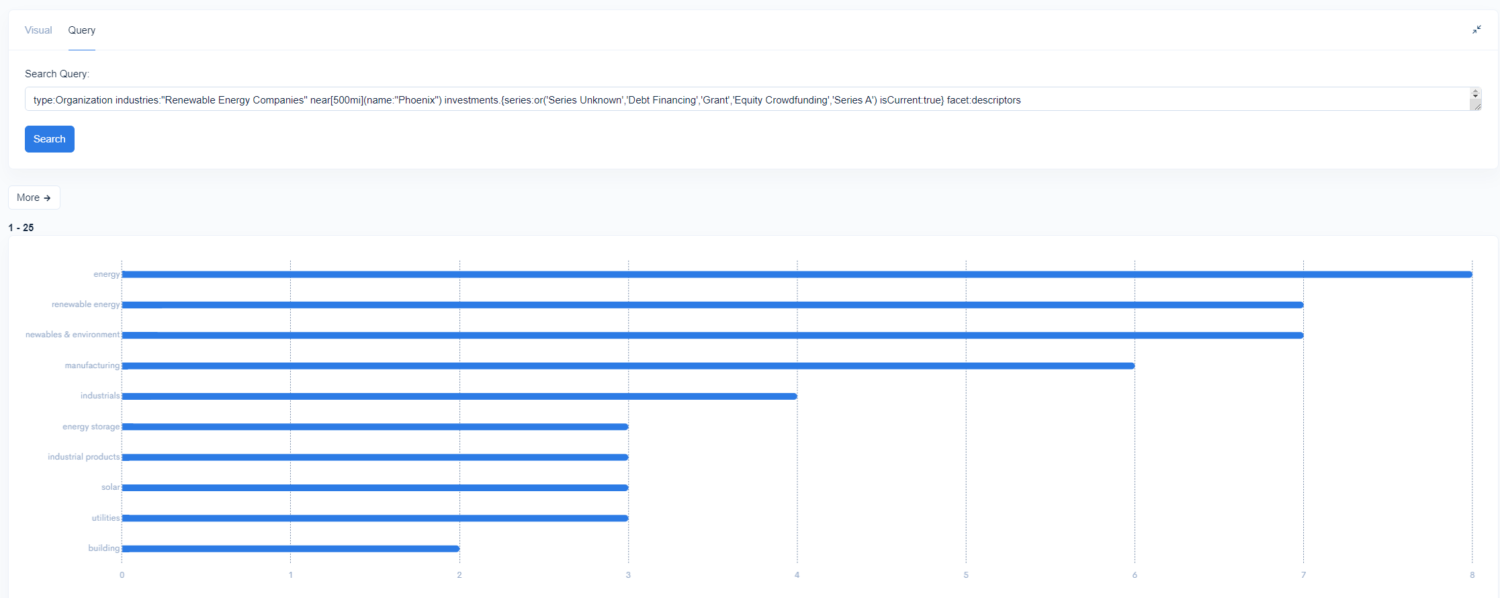

Two useful fields to obtain summary views of for a group of organizations include descriptors as well as industries.

Those respective queries can be seen below:

Or

Within the industries facet query, we predictably see that these organizations are both “energy” and “renewable energy companies.” We can also see that solar power– in particular — as well as manufacturing tend to be most commonly invested in.

Within descriptors we can jump to specifics that are more granular than entire industry. In this case perhaps our hypothetical organization is already involved in building or energy storage (or are considering an expansion in these areas). Below they can find validation that similar organizations have been invested in, and surface an even more targeted list of organizations to deep dive into.

In order to shorten this list of organizations to only those who are described as working in energy storage and building, we could add a descriptors filter to our query.

The above query surface 8 organizations who are beyond seed funding, not yet to close to an IPO, provide energy storage and building services within the renewable energy industry and who are regional to Phoenix, Arizona. With a targeted list this size we can begin to look at each and every investor manually.

Investigating A Targeted List Of Investors

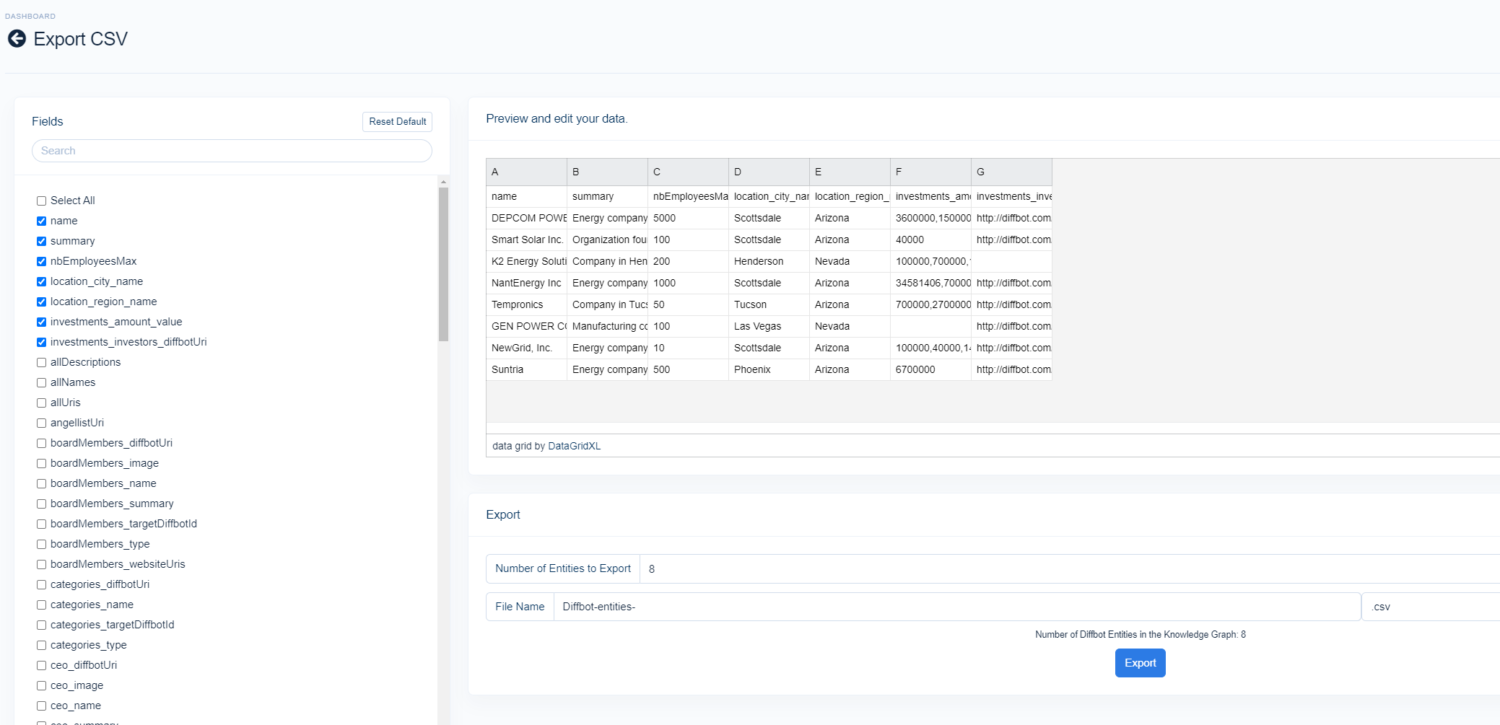

Now that we have a targeted list of organizations we can grab a list of all their investors. One route to quickly generate the list of investors is to simply add facet:investments.investors.diffbotURI to the end of the query. Another route is to export the investor fields into CSV.

The fields we may find of interest include investments_amount and investments_investor_diffbotUri. Also referencing the size and summary of the invested-in organizations to verify they are similar enough to your current firmographics.

DiffbotURIs are unique identifiers for entities in the Knowledge Graph. In the event entities have similar or identical names, DiffbotURIs are a more precise way to reference the actual organization of interest and disambiguate.

Once you have this list of DiffbotURIs, we can string them together into an “or” statement for organization, article, and person entity analysis. In our case there are 18 investors, 11 of which are unique. If you were looking for a serial investor in this space, this would also be promising by mining in to which of these organizations have invested in multiple of our 8 company target list.

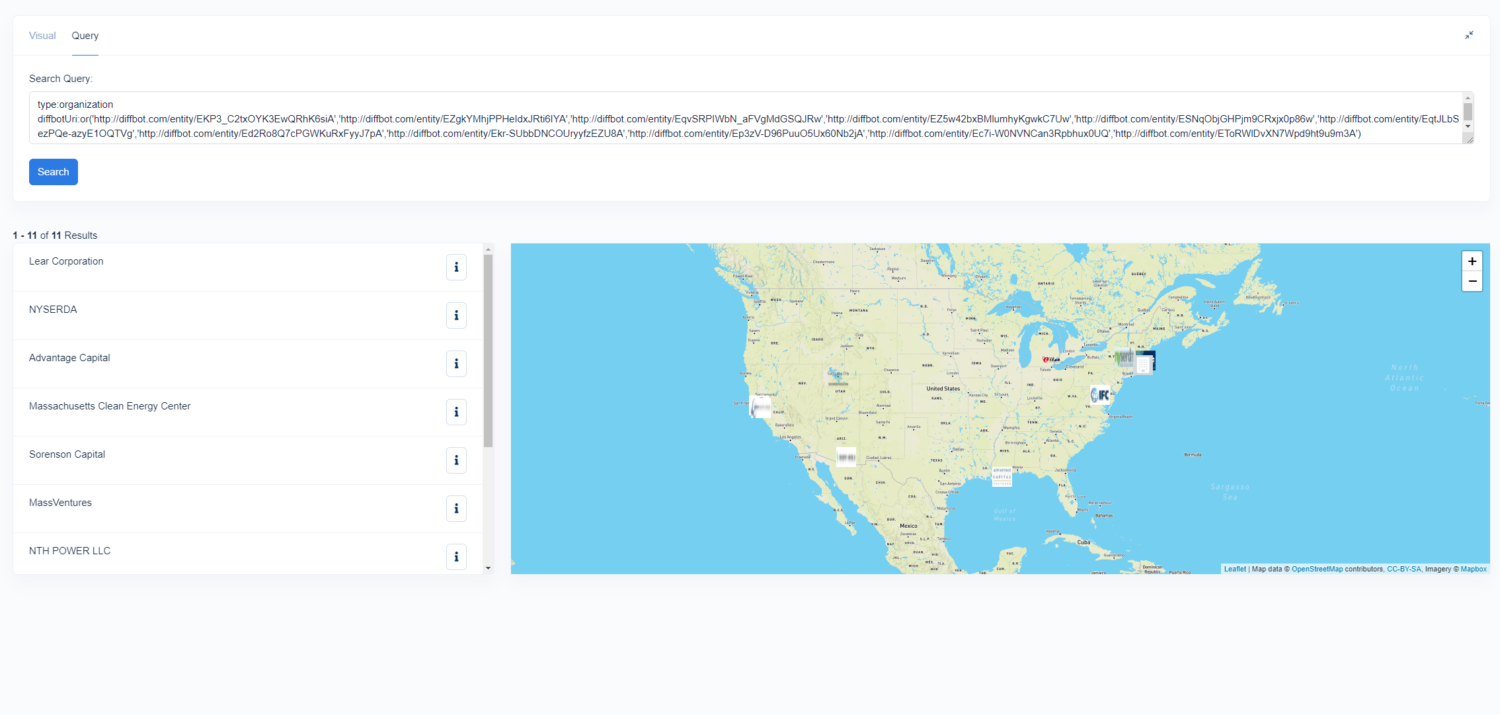

We can start by simply returning the list of investors with the following query:

type:organization diffbotUri:or('http://diffbot.com/entity/EKP3_C2txOYK3EwQRhK6siA','http://diffbot.com/entity/EZgkYMhjPPHeIdxJRti6IYA','http://diffbot.com/entity/EqvSRPIWbN_aFVgMdGSQJRw','http://diffbot.com/entity/EZ5w42bxBMlumhyKgwkC7Uw','http://diffbot.com/entity/ESNqObjGHPjm9CRxjx0p86w','http://diffbot.com/entity/EqtJLbSezPQe-azyE1OQTVg','http://diffbot.com/entity/Ed2Ro8Q7cPGWKuRxFyyJ7pA','http://diffbot.com/entity/Ekr-SUbbDNCOUryyfzEZU8A','http://diffbot.com/entity/Ep3zV-D96PuuO5Ux60Nb2jA','http://diffbot.com/entity/Ec7i-W0NVNCan3Rpbhux0UQ','http://diffbot.com/entity/EToRWlDvXN7Wpd9ht9u9m3A')

A quick view of the entities mapped shows that few of these organizations are regional. Meaning you may not need to limit your investor search by region.

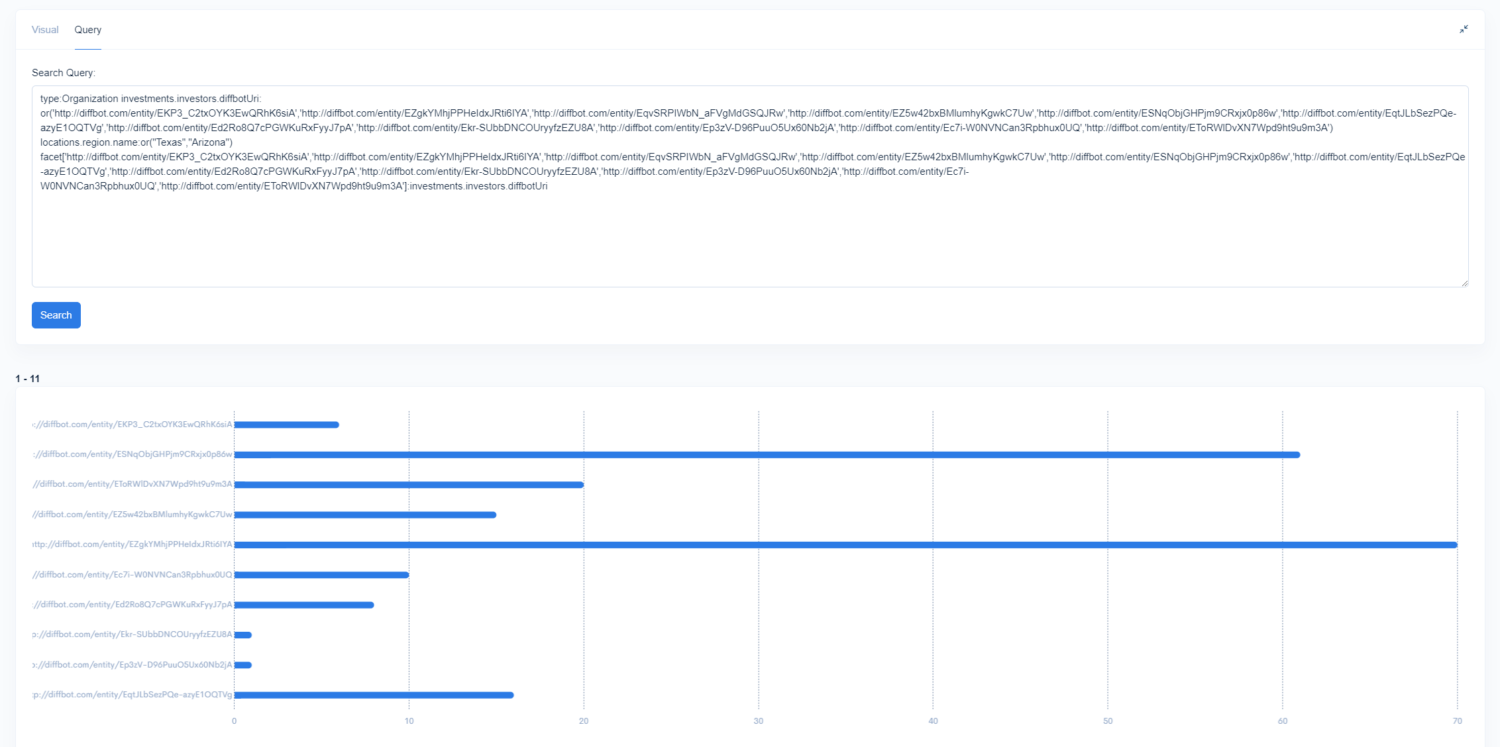

A second search we can perform is to look at all organizations who have been invested in by these 11 investors to surface their broader interests. We can then facet through location and industry.

The largest industry clusters for investments from these organizations include software, energy, manufacturing, renewable energy, solar, and computer hardware.

By clicking through any one of these facet results, you can see a list a companies invested in with that specific industry. For example, clicking through solar energy companies yields over 200 companies invested in by this cohort. This can be used to provide another view of the types of observations surfaced in the first and second sections of this guide.

A second facet query around location of invested-in organizations can be useful to start focusing on which investors tend to invest within the region. We can filter by organizations in states located in the Southwest and then facet by investor to get a view of which of these investors invests the most in Texas and Arizona. While the below query is quite lengthy, the basics are simple, passing in the DiffbotURI of specific investors and then bounding (the DiffbotURIs inside of the square brackets) our facet query at the end to only return results about the same set of investors.

This final view shows a clear winner, a DiffbotURI we identified as a investor within our targeted list of renewable energy companies in an earlier section and who can see has invested in 70 companies in Texas and Arizona from this view.

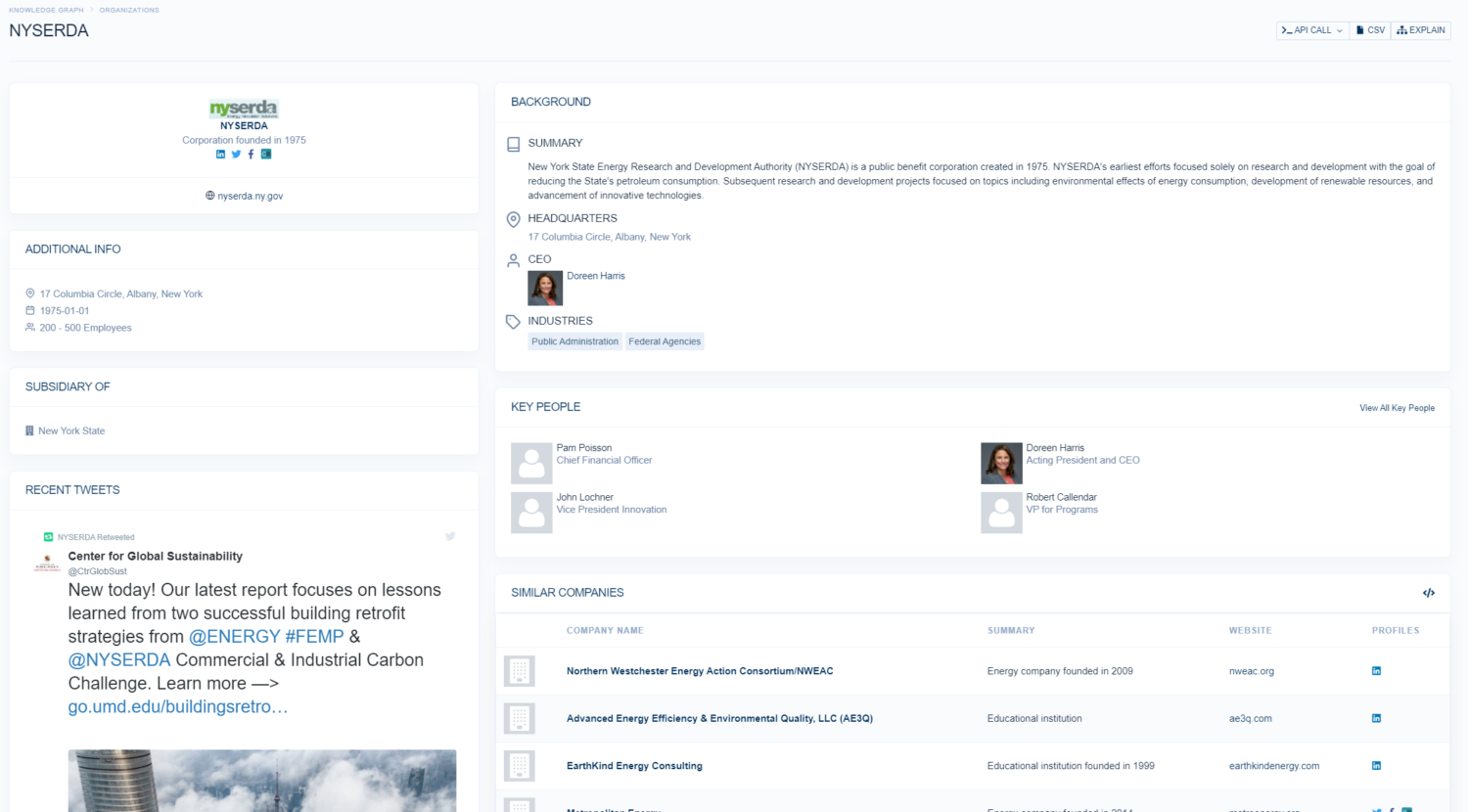

This DiffbotURI resolves to the New York State Energy Research and Development Authority, a public benefit corporation that may be a great candidate to look into for potential investment.

Armed with a single (or handful) of DiffbotURIs we can look for news coverage of these entities, key individuals to reach out to, and more.

DiffbotURIs can show up as topical tags mentioned in articles. Tags are natural language processing-generated topics found in articles within our article index. They are available in content of every language and are presented in English.

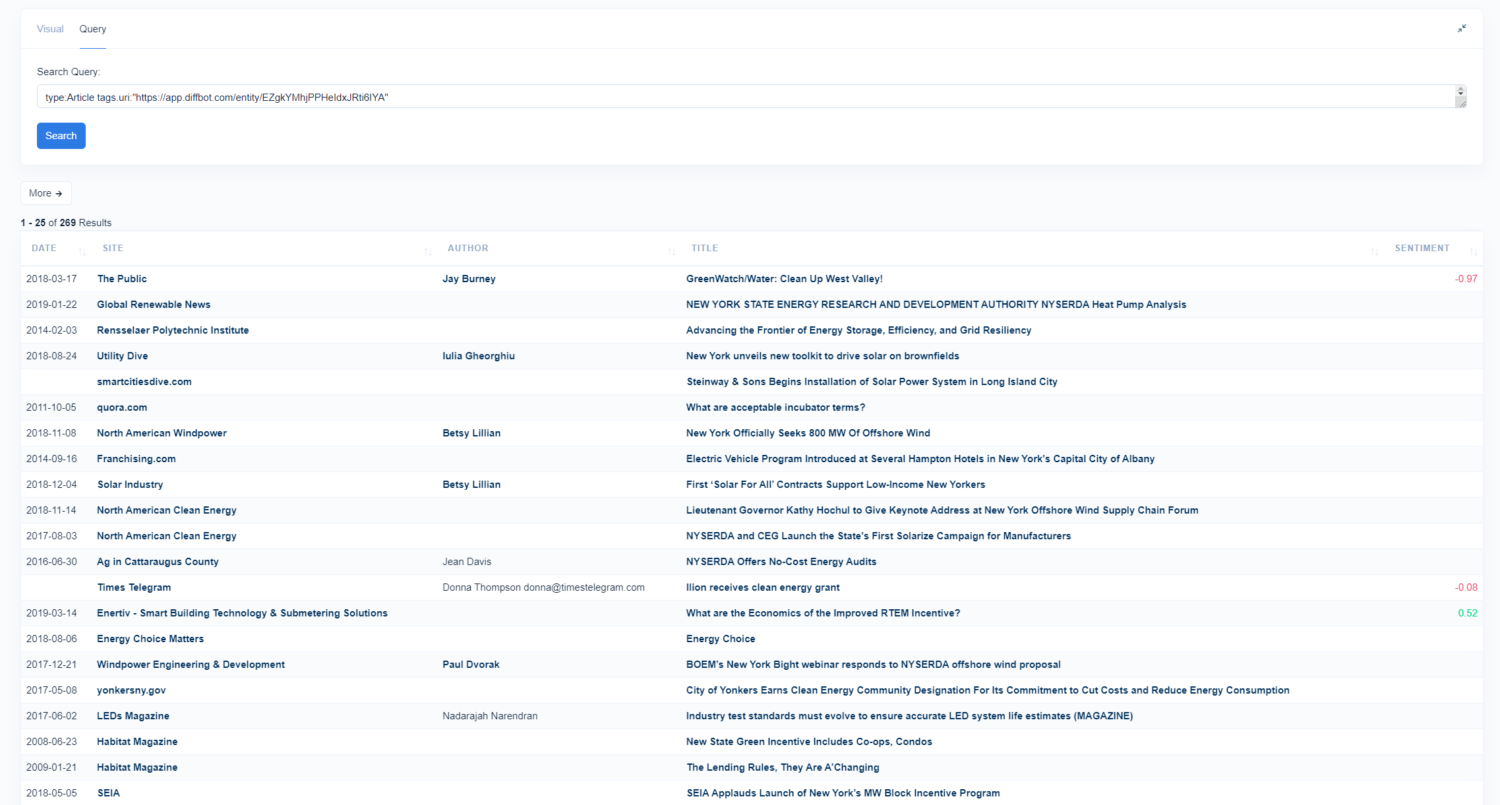

The following query looks at articles we’ve identified as mentioning the New York State Energy Research and Development Authority. At present over 260 results are returned.

type:Article tags.uri:"https://app.diffbot.com/entity/EZgkYMhjPPHeIdxJRti6IYA"

Using an ‘or’ statement similarly to prior queries we’ve worked through, we could also return a larger newsfeed of all of the investors we’re interested in. An alterative route to expanding your list of organizations is to utilize our similarTo query. Our machine learning computed similarity scores are present for every unique pairing of Knowledge Graph organizations. The syntax for expanding your list of interesting orgs for news monitoring via similarTo would look like the following.

type:Organization similarTo(id:"EZgkYMhjPPHeIdxJRti6IYA")

The above returns 25 organizations most similar to our investor of interest.

Jumping back to useful article queries that start from a list of organizations, the sentiment field can be a powerful way to quickly surface actionable data. By adding sentiment>0 date<365d to our article query above we can see positive news about an entity over the last year. This can be used to quickly assess where industry successes and expansions are occurring.

Finally, we can use the name(s) of our investor of interest to search through person entities connected to this entity. In this case, this could involve looking at hiring trends (e.g. an entity is expanding in the southwest, or with analysts related to a specific technology). It can also be used to discern the proper contacts in a use case like we’re describing in this guide. In our case, some of the useful fields we may wish to look at include:

- Skills

- Seniority

- Role

- New Hires

- New Locations

- Details Related To Personalization of Outreach

- Among Others

While fundraising isn’t one of the most common uses for the Knowledge Graph we see, many organizations that understand the basic strengths of Knowledge Graph data do go on to use our data for a variety of uses. On one level, most tasks that require manually gathering information from the web for further analysis can be completed at a much larger scale within the Knowledge Graph.

If you enjoyed this guide and are looking for additional guides on market intelligence or news monitoring uses of the Knowledge Graph, grab a two-week free trial and check out our Knowledge Graph Getting Started Guide.

You must be logged in to post a comment.