Sure, you want to get your message out to the whole world. The thing is — no matter what you sell — not everyone is going to be a customer. Period. In fact, chasing the wrong audience may well eat up time and money and leave you further behind with your existing or ideal audiences.

And while you may not be trying to “sell a cape to superman,” improper targeting of marketing campaigns is more common than you may think.

It’s estimated that up to 80% of content marketing is targeting the wrong audience.

Simultaneously, the 20% of content and outreach that does work works really well.

What You Want: The Marketing Flywheel

A flywheel is an engineering term for a device that efficiently stores rotational energy. Flywheels tend to be hard to get started, but can provide sustained rotation with little effort once they’re rolling. Flywheels are commonly used to provide continuous output of power in systems where an energy source isn’t continuous.

In terms of marketing and sales actions, a flywheel can gain steam by the following steps:

- Attracting

- Engaging

- Delighting

The individuals who are present for these steps ideally move through the customer lifecycle:

- From strangers

- To prospects

- To customers

- To promotors

Who then help to attract additional strangers.

What You Need: Relevance

If you’ve been through a marketing or sales rodeo or two, you know that promoters are few and far between. These individuals have been thoroughly attracted to your cause. They don’t work on your team, but they get why you’re doing what you’re doing. And they see your product or service as indispensable to their job or task.

In short, promoters couldn’t imagine doing their job without your product or service. Your messaging AND products are relevant to them.

When looking at developing promoters of your product in a systematic way, we can start to see a few trends.

- Your best buyers feel like you get the challenges they’re faced with

- Your best buyers feel like you get how they make decisions

Discerning what challenges are most critical to your buyers and how they make decisions are crucial components of describing an ideal customer. And one lens through which this occurs is market segmentation.

The Prerequisite: Market Segmentation

If you were the principal of a school, you wouldn’t want to have the same conversation in the exact same way with all of your stakeholders. The needs of your star teacher, the school district lawyer, and the parent of a student who is struggling at school are entirely different. They’re making decisions based on different metrics. The same messaging simply won’t work when applied to all three. And yet you, as the principal are tasked with providing some service to all three.

This is where market segmentation comes into play.

At it’s simplest, market segmentation is simply separating a group of people into clusters so you can have a conversation with them that speaks to their needs.

In B2B marketing and sales, market segmentation is commonly facilitated by the following data types:

- Firmographic data: how large is the company; what industries are they in; are they growing or shrinking; what is their budget like; where are they located

- Demographic data: what role within the company should you reach out to; how should you contact them; how can you relate to your audience

- Psychographic data: what do these individuals value; what are their priorities; what are their pain points; what gets them excited; what topics do they care about; what are their perceived barriers

- Behavioral data: what tools do they use; how often do they use them; what tools do they think are lacking; what tools do they think are excellent

Whether you’re scoping out a new market segment that’s untested, or you have a plethora of past ideal customers to extrapolate from, the above data points begin to answer tangible questions:

- How can I reach my ideal customers (what channel should I use)?

- What are the most pressing issues of my ideal customers?

- How can I provide value to my ideal customers?

- What efforts are likely to attract, engage, and delight my ideal customers?

One Data Source To Rule Them All: The Public Web

Market segmentation occurred long before the internet. But the internet has changed market segmentation in a few critical ways.

- Nearly every entity of size has a footprint on the public web

- Nearly every potential buyer has some public web data from which to infer their interests, needs, and largest stumbling blocks

- You can readily study what content and outreach has worked for others reaching out to your ideal audience

- Your audience is potentially global

- There are more channels to reach your audience than ever before

- Feedback about your marketing efforts occurs much more rapidly on the web

While many of the above characteristics of public web data aid market segmentation, there’s an issue. Data on the web is spread across billions of sites. And if your market is of any size, it’s not really feasible to manually gather all the firmographic, demographic, psychographic, and behavioral data you need.

Many marketing and sales teams are searching for a better way, and wrangling with what data teams have long known: that data gathering, structuring, and cleaning is most of the battle.

At Diffbot, our mission is to structure the world’s knowledge. And for us that means crawling the web to provide structured data on organizations, people, products, articles, and more.

A Better Way To Search: The Knowledge Graph

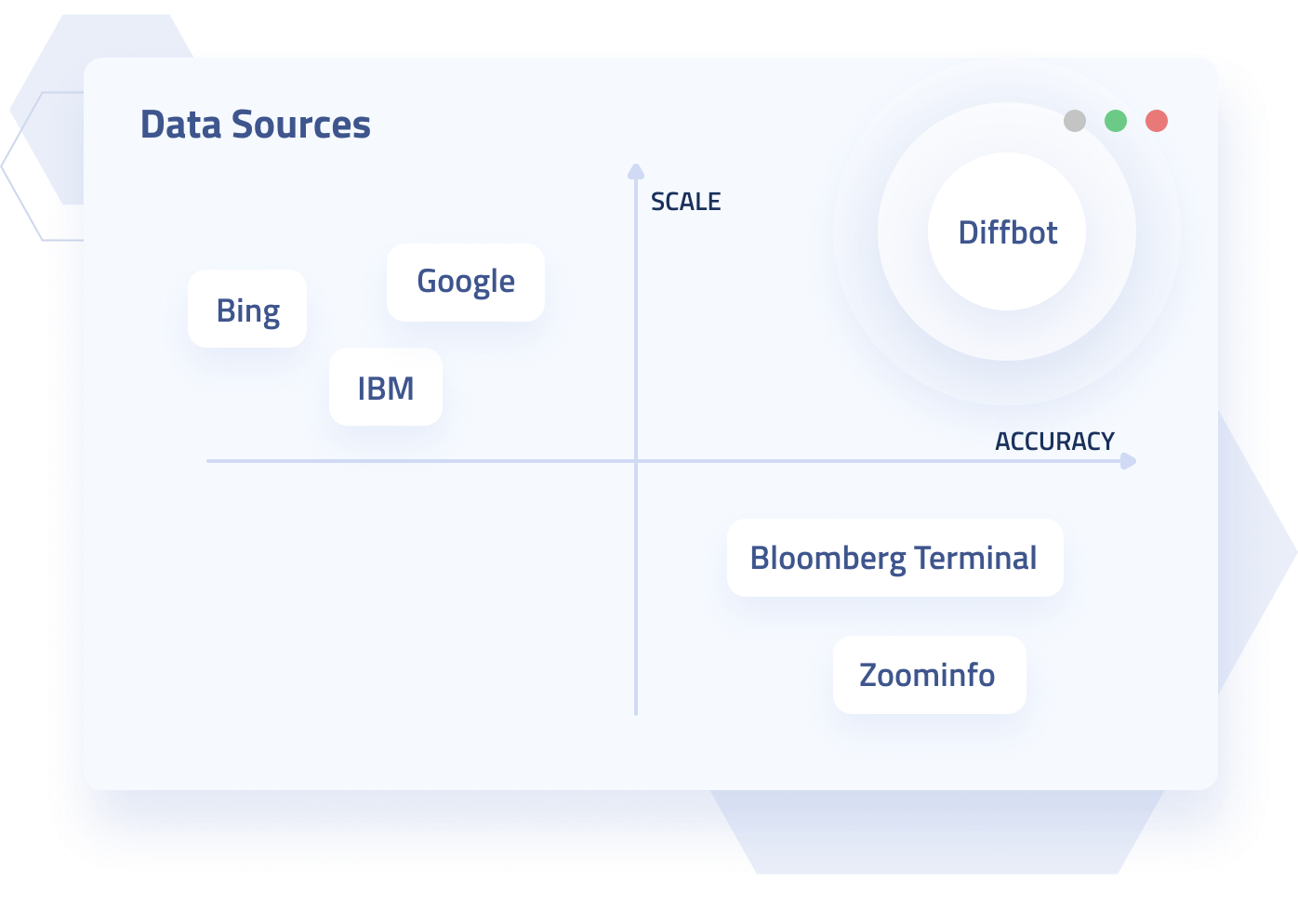

Diffbot’s Knowledge Graph enables teams to filter entities and surface data on those entities unlike any search engine. Many of these entities hold valuable data for market segmentation.

Number of entities in the Knowledge Graph*

- Article entities: 1.3B

- Person Entities: 715M

- Organizational Entities: 242M

*The number of entities in our Knowledge graph fluctuates each time the web is crawled and new entities and connections are surfaced. These numbers apply to April 28, 2021.

Within each entity, facts that pertain to that entity are sourced from across the web. For example, an organization entity may contain the following fields:

- Founding date

- Key people

- Technologies used

- Industries

- Funding rounds

- News mentions

- Locations

- Subsidiaries

- And more

Meanwhile an article entity may contain other fields:

- Title

- Sentiment

- Topical tags

- Mentions of entities

- Author

- And more

These fields mean you can specify precisely what you want returned instead of manually sifting through content for market segmentation data.

Sortable, Faceted, Structured: Market Segmentation Queries in the KG

Whether through our simple visual query editor or by learning Diffbot Query Language, a huge range of market segmentation-related queries can be performed within the Knowledge Graph.

To provide a sampling:

- Over 46,000 mid-market software companies around the world.

- The largest employers of data-related roles.

- The top investors in video game companies.

- 980 PhD’s specializing in negotiation strategy.

- The location of over 500 Whole Foods.

- Founders who were previously VP’s or Directors at FAANG companies

Through sourcing data points using natural language processing and machine vision, Diffbot helps to remove manual data gathering and enables market segmentation datasets of massive proportions. Results from queries are exportable or can be leveraged directly within custom dashboards or applications via our KG API.

Getting the Most From Market Segmentation: Best Practices

While there’s a world of market segmentation data available online, you should look for the following characteristics to get the most impact.

- Market segmentation data should be measurable. This means that you should be able to clearly delineate who is in your ideal audience and not. Additionally, as you gather more data points through interactions with this audience, you should be able to calculate what percentage will convert, what your segment is willing to spend, and what an expected ROI is.

- Members of your market segment should be reachable. You can isolate your ideal audience perfectly and end up with useless data if you don’t know how to start a conversation. This involves some trial and error as well as inference and observation. For example, an ideal customer persona who is younger may gravitate towards the newest social media platforms, while a tech resistant audience may be easier to reach through printed ads.

- Be targeted but don’t whittle down your segment. This is where a robust long tail data set comes into play. You want to know that individuals you’re reaching out to clearly fit your ideal audience, but you don’t want to limit yourself to a few chances. All but the most niche products can support substantial audiences that are still targeted.

- Learn buying habits and protocol. As customers move through their customer lifecycle, you should be able to note how decisions are made within their organizations. For some segments you may be dealing with accounting, legal, and other stakeholders. For others the choice to purchase may be performed by a single point of contact. Incorporate this knowledge to refine your segments with who is actually “choosing” to buy your product.

- Segments should perform distinct actions. Segments can also be organized by how they react to your marketing efforts and their behavior while participating in your customer lifecycle. Can your segment be subdivided into groups that are resistant to upsells and those who aren’t? Do you have a segment that splits into self service or custom solutions? These may be reasons to split messaging and interactions between the groups even if on one level they could be a single segment.

To explore the world’s most robust market segmentation dataset, sign up a 2-week free trial or reach out to sales@diffbot.com today!

You must be logged in to post a comment.